December 2014 | Vol. I, Issue 2 | Center for Health |

|||||||||||||

Articles

PLAN SPONSOR/CONFERENCE SPOTLIGHT Annual Conference Pilots ‘Local Church Option’ StrategyThe Center for Health has discussed diverse health plan strategies for clergy and lay employee health coverage—from maintaining the status quo, to eliminating group health plans altogether, to splitting the participant population into coverage subgroups. Earlier this year, Northern Illinois Annual Conference launched a pilot project to evaluate the “Local Church Option” strategy.Under the Local Church Option, the annual conference permits local churches—in their role as small employers participating in the conference’s employer group health plan—to opt out of the group health plan. Because their local church “employer” is not offering affordable health coverage, clergy at these impacted churches can then seek coverage through the public Health Insurance Marketplace (also called the “public exchange” or “public Marketplace”) and may qualify for premium tax credits (PTCs) toward the cost of that coverage. Northern Illinois Conference—a HealthFlex plan sponsor—targeted 33 of its nearly 400 local churches for the Local Church Option pilot. The local church, conference and clergyperson must collectively agree before the clergyperson chooses to participate in the pilot program. According to Lonnie Chafin, conference treasurer for the Northern Illinois Annual Conference, pastors and churches selected for the pilot generally fit these criteria:

After conference discussion with their identified local churches and clergy, 23 churches opted out of the group health plan, while 10 remained in HealthFlex.

Since PTC-eligibility is based on household income combined with family size, clergy with larger families and/or no working spouse were the most likely to choose exchange coverage (and more likely to qualify for PTCs), while clergy with working spouses were the least likely to choose public Marketplace coverage (and less likely to qualify for PTCs). Northern Illinois Conference is compensating individuals for increased out-of-pocket costs of a public Marketplace plan by adding a commensurate taxable salary increase (cost of the plan + 35% for taxes, etc.). The conference required that alternative plans selected by clergy have deductibles and co-payments comparable to the HealthFlex plan it offers conference-wide. Cost Impact For the 23 churches that opted out of the group plan, the Northern Illinois Conference is realizing a 50% savings by replacing the group plan premium historically paid for these clergy with the taxable salary increase to reimburse them for alternative coverage. Taking into consideration its own administrative costs, the conference is able to rebate 33% of health plan costs back to participating churches. Potential cost savings for any conference considering this approach will depend on many factors. For example, cost savings might be lower if a larger segment of the covered population moved out of the group health plan. Individuals who are not eligible for significant PTCs might require greater salary increases to mitigate public Marketplace plan costs, which could erode the savings. Conferences that pay for clergy-only coverage—rather than family coverage—would likely see lower savings than Northern Illinois realized. Navigator Guides the Way In his October 2014 presentation to the Association of United Methodist Conference Pension and Benefits Officers (AUMCPBO), Chafin stressed the significant value the annual conference found from using a navigator to meet one-on-one with clergy and their families who were considering the move to the public Marketplace. Navigators complete comprehensive federal training in issues related to the Affordable Care Act and public Health Insurance Marketplace. The navigators then provide assistance with applications, plan selection and referrals to other consumer assistance programs. The navigator for Northern Illinois Conference was a United Methodist deacon who had undergone the requisite training. “The Navigator proved invaluable to us because the deep knowledge and broad experience with the offerings got us quickly to a workable solution for our clergy members. The navigator knew how to check plans for in-network doctors and ongoing prescriptions, and also knew how to speedily jump the hurdles we faced,” said Chafin. The navigator provided crucial support by:

Further Considerations While implemented on a limited basis so far, Northern Illinois Conference’s movement from the traditional group plan to public Marketplace coverage for this small population raises many questions for consideration—most notably related to clergy appointments and itineracy. These questions may be more complex in conferences like Northern Illinois that choose a split-coverage approach for their clergy—keeping some in the group plan while allowing others to opt out. Conferences must consider:

There are no clear answers. Pros and cons of the Local Church Option and other health plan strategies are outlined in Health Care Reform Update—Issue #1.

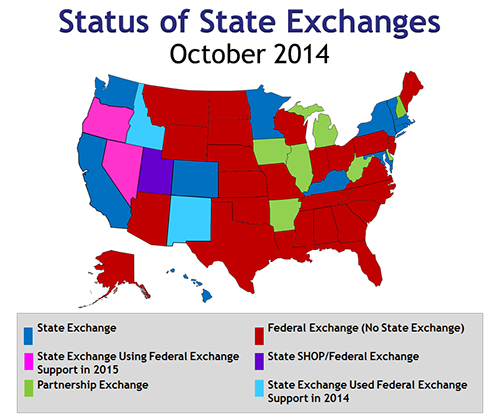

LITIGATION SPOTLIGHT Recent ACA Litigation—Premium Tax CreditsOpponents of the Affordable Care Act have turned to the courts to challenge the ACA’s validity and constitutionality, reaching as high as the U.S. Supreme Court in their efforts to overturn the law entirely or eliminate select components.Currently, the biggest legal threat to the ACA focuses on the legitimacy of premium tax credits (PTCs) for individuals obtaining coverage through the federally facilitated Health Insurance Marketplace (also called the “public Marketplace” or “public exchange”), as argued in Halbig v Burwell* and King v Burwell. These challenges hinge on a few words out of nearly 1,000 pages of ACA text. At issue is whether people who obtain health coverage through the federally facilitated public Marketplace—rather than a state-established exchange—can qualify for PTCs. PTCs are federal tax subsidies to help low- and middle-income households pay for their health insurance premiums when purchased through an exchange. In 2014, 16 states offered state-operated exchanges. An estimated 4.7 million residents in the 34 states with no state exchange turned to the federally facilitated public Marketplace or partnership exchanges for health coverage (red and green on map below).

Mixed Messages On July 22, 2014, two federal courts of appeals issued opposite opinions regarding the federal vs. state exchange question.

Supreme Court Steps In Three days after the November mid-term elections, the Supreme Court announced that it will hear the King case in Spring 2015, with a decision likely by June. This assures that the Supreme Court will rule on the premium tax credit issue during its current term—deciding once and for all whether the tax credit subsidies apply to the federally operated public Marketplace (34 states) or only when a state-run exchange is available (16 states). In the first year, nearly 5 million people purchasing insurance through the federally facilitated public Marketplace received premium tax credits to help them afford health insurance. These PTCs averaged $4,700 per person. Should the Supreme Court decide that PTCs are not eligible under the federally operated public Marketplace (i.e., if the court agrees with the initial Halbig ruling), it is believed the Internal Revenue Service will likely apply that ruling moving forward, (i.e., prospectively only, rather than requiring people to pay back PTCs already received). More importantly, if the Supreme Court rules against PTCs for the federal public Marketplace, health insurance would become less affordable for low- and middle-income individuals in 34 states relying on the federal Marketplace. In turn, the ACA’s economic viability would be seriously jeopardized. For more details about ACA litigation and court decisions, click here. ACA Future—More Uncertain than Ever In addition to scrutiny in the courts, the ACA will likely face stronger challenges in the next two years from the Republican Party, which gained control of the U.S. Senate in the recent mid-term elections and gained more seats in the House of Representatives. Although full repeal is unlikely as long as a Democrat is president (due to the veto power), there could be amendments to some provisions in the next Congress. The General Board continues to monitor ACA-related issues and will keep plan sponsors informed as events unfold in the courts or Congress. * Sylvia Burwell: Secretary, U.S. Department of Health and Human Services as of June 2014. (Previous secretary: Kathleen Sebelius, i.e., Halbig v Sebelius and King v Sebelius.)

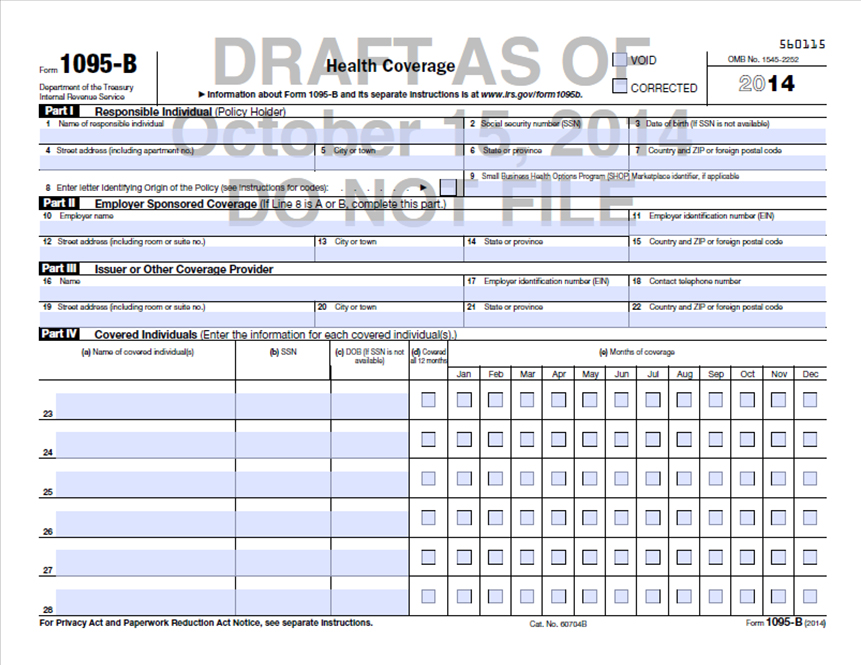

REGULATORY SPOTLIGHT Reporting Requirements—Sections 6055 and 6056New reporting requirements for Sections 6055 and 6056 will be based on 2015 data, so plan sponsors (not in HealthFlex) and applicable large employers (whether or not in HealthFlex) should begin capturing the required data in January. This article summarizes the “who, what and when” to help you comply with reporting requirements that will be due in Q1 2016 but require 2015 data tracking.Section 6055 Reporting (minimum essential coverage reporting)—Forms 1094-B and 1095-B Section 6055 reporting applies to health plans of all sizes. This reporting monitors whether health plans meet minimum essential coverage (MEC) standards, as defined by the ACA. Plans or plan sponsors will need to provide documentation in early 2016 to: 1) individuals covered under the plan; and 2) the Internal Revenue Service (IRS). Who Reports

What Data Is Needed Section 6055 reporting for 2015 must include:

When to Report

Section 6056 Reporting (Employer Mandate reporting)—Forms 1094-C and 1095-C Section 6056 reporting applies to applicable large employers. This reporting verifies that employers provided affordable, minimum essential coverage to full-time employees and dependent children over the prior year. Who Reports

What Data Is Needed Section 6056 reporting tracks employees’ offer of coverage and affordability information for the prior calendar year. Reporting for the 2015 calendar year must include:

When to Report

Combining 6055 and 6056 Reports Because of the overlap of data required—particularly regarding participants’ information—applicable large employers (50+ FTEEs) may satisfy their reporting obligations under both Section 6055 and Section 6056 using a single, combined form. These employers may use Form 1094-C and Form 1095-C to report minimum essential coverage and employer offers of coverage to FTEs. This flexibility is intended to make the reporting requirements easier for applicable large employers. In the Church world, there may be some reporting duplication for individuals working for large employers, with the health plan (or annual conference for self-insured conferences) completing Section 6055 reporting and the employer completing Section 6056 reporting. For example, if the annual conference does the Section 6055 reporting (Form 1095-B) for all covered lives in the plan but a participating local church must do Section 6056 reporting (Form 1095-C) as an applicable large employer, the local church may end up reporting minimum essential coverage on Form 1095-C where the annual conference has reported the same information to the IRS through Section 6055 (Form 1095-B). The sooner you set up methods to capture data in 2015, the easier your reporting will be in 2016. For more details about reporting, click here. Other Deadlines to Note

Under the ACA’s Individual Mandate, individuals also will face new reporting requirements on their 2014 tax returns (due April 15, 2015) to verify that they have health coverage and to calculate any PTC for which they qualify. Individuals also will need to report any advanced PTCs received through the public Marketplace. Looking ahead to 2015 tax reporting (due April 2016), the new tax reporting requirements may also involve attaching copies of Forms 1095-B or Forms 1095-C to one’s tax return.

LOCAL CHURCH SPOTLIGHT Reminder: Non-Taxed Payment for Individual Coverage ProhibitedA friendly reminder to local churches and other employers: employer payment plans (EPPs), stand-alone health reimbursement accounts (HRAs) or other non-taxed vehicles that reimburse employees for individual health plans or medical expenses are prohibited by the Internal Revenue Service (IRS). This ban took effect January 2014.“Employer payment plans” describe an informal practice intended to help employees afford individual health coverage—typically, part-time pastors, local deacons and lay employees who may not be eligible for the group health plan. These practices were previously allowed under a 50-year-old guidance (Revenue Ruling 61-146). Employer payment plans or health reimbursement arrangements use non-taxed dollars and generally work something like this:

This may include programs previously acceptable under Section 105. In any case, payment is made with dollars that are not reported as taxable income to the participant. This practice must be discontinued due to IRS rules. The IRS has informally indicated that it will begin enforcing this rule more stringently in 2015. Moreover, these types of arrangements would qualify as minimum essential coverage (MEC) under the Affordable Care Act (ACA). This has two effects: 1) the arrangement would disqualify the employee from a premium tax credit (PTC) for public Marketplace coverage (causing him or her to have to repay any PTC received), and 2) the local church offering the arrangement would be required to report the coverage as MEC under Section 6055 reporting requirements (on Form 1095-B) in early 2016 for any such arrangement in 2015. Failure to report MEC under Section 6055 carries monetary penalties. Recently, the IRS, Department of Labor and Department of Health and Human Services collectively published guidance that reiterated this restriction (ACA FAQ XXII). In that FAQ, the IRS stated plainly that these arrangements are considered group health plans under the ACA and fail to satisfy the ACA’s rules prohibiting annual limits on essential health benefits. These arrangements will therefore be subject to penalties under Section 4980D of the Tax Code and an excise tax of $100 per day per affected individual in the plan. This penalty—up to $36,500 annually per employee—is assessed on the plan sponsor (i.e., the employer). Taxable Arrangements In the FAQ, the IRS also warned employers that taxable arrangements to reimburse employees for premiums paid for individual insurance policies may also violate the ACA as a group health plan. It seems that making the added pay contingent upon proof of purchase of an individual insurance policy makes even the taxable arrangement a “group health plan” subject to this rule. Permitted Alternatives The most fail-safe way to assist employees in purchasing individual insurance policies is to increase their salaries without conditions on the extra pay. Earlier guidance on the matter (Notice 2013-54) laid out a safe harbor for a taxable EPP in which the employer directs a portion of an employee’s taxable wages to the issuer of individual insurance policies. Employers may establish payroll practices of forwarding post-tax employee wages to a health insurance issuer at the direction of an employee, without establishing a group health plan, if these Department of Labor regulatory standards are met:

Conferences can send this template letter to their local churches as a reminder. Read more about this issue and potential alternatives here. Copyright © General Board of

Pension and Health Benefits |

|||||||||||||